Some of methinks’s existing customers include streaming media and games companies that need to understand the impact of COVID-19 on the overall entertainment industry. Live sports marketing and advertising dollars — tickets, broadcasts, memorabilia, tourism and travel — have impacted the media industry, significantly, because the events and content have been discontinued, with little hope of return in 2020. But, the impact of COVID-19 on sports entertainment is not all about the event-related revenues, broadcast dollars and streaming subscriptions; What sports fans are doing instead of watching sports and attending games provides clues into new revenue opportunities for sports leagues and franchises. And, the prevailing assumption is that parallel entertainment providers can change lanes and fill the void for sports fans with sports-related games, online communities and more. We’ll see if that assumption is safe or not based on the insights from our methinks Thinkers.

But, before we dig into the viability of new and additional sports entertainment opportunities, let’s look at the May 2020 methinks Thinker poll of US Sports fans to understand their general concerns about sporting events, once major professional sports leagues resume.

Polling results:

Summary of Sports Fan Return-to-Attendance Expectations and Attitudes

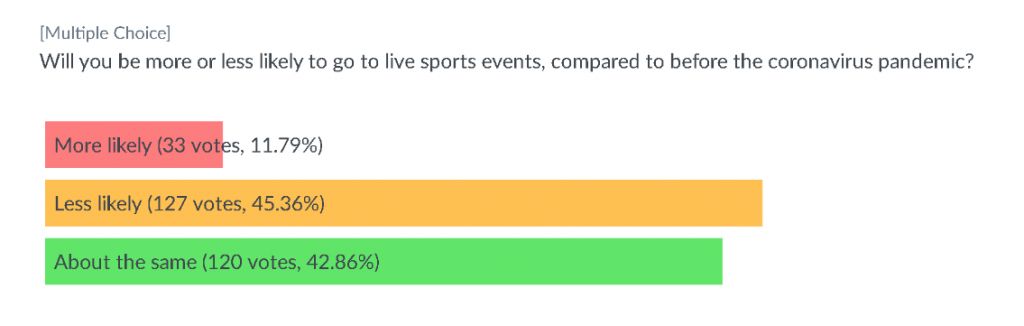

- Over 45% of respondents stated they are less likely to attend live sports events (compared to before the coronavirus pandemic) once they become available. This suggests that the recovery in event-related revenue will be long, and not immediate. People are going to want to feel safe and have their concerns addressed.

- Less than 12% of respondents stated they will be more likely to go to sporting events.

- Nearly 43% of respondents stated that they will be just as likely (as before COVID-19) to attend sporting events open for spectators. Here’s the qualitative drill-down based on interviews with respondents:

○ Interviewed respondents stated they will be just as likely as before because they love live sports. But, again, the respondents are not likely to return initially.

○ 100% of interviewed participants said they will be hesitant until COVID-19 vaccines are established.

○ They also want to hear/see in the news that (a) the coronavirus is no longer a major threat, (b) widespread testing is available, and (c) treatments are available that make COVID-19 symptoms less dangerous.

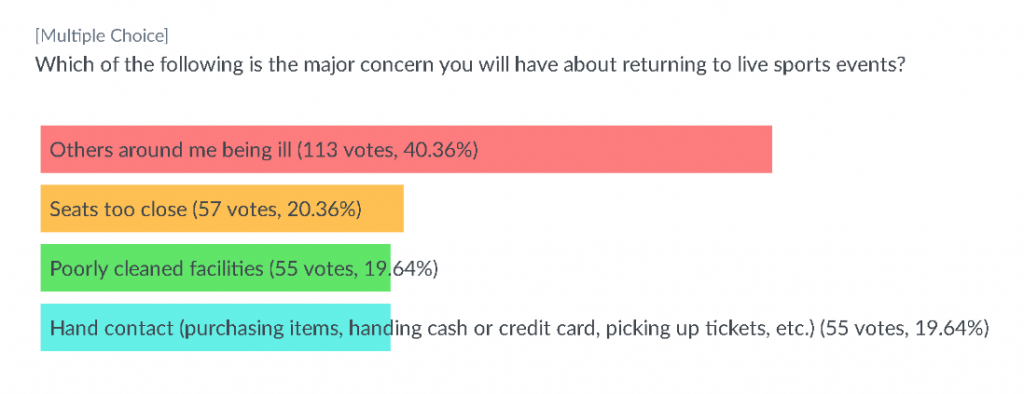

- Approximately 40% of respondents stated that they are primarily concerned with others around them being ill should they attend live sports events. While these fears can potentially be overcome with intentionally lowered-capacity events, this concern underscores a long road to full recovery for major sporting events.

- Other factors that may facilitate infection transmission, such as a) seats being close together, b) poorly cleaned facilities, and c) hand contact that occurs when purchasing items, handing over cash or a credit card, etc., were selected as the primary concern by approximately 20% of respondents each.

- Thus, the facilitating factors are overall less concerning to respondents than the idea of nearby presence of potentially ill individuals

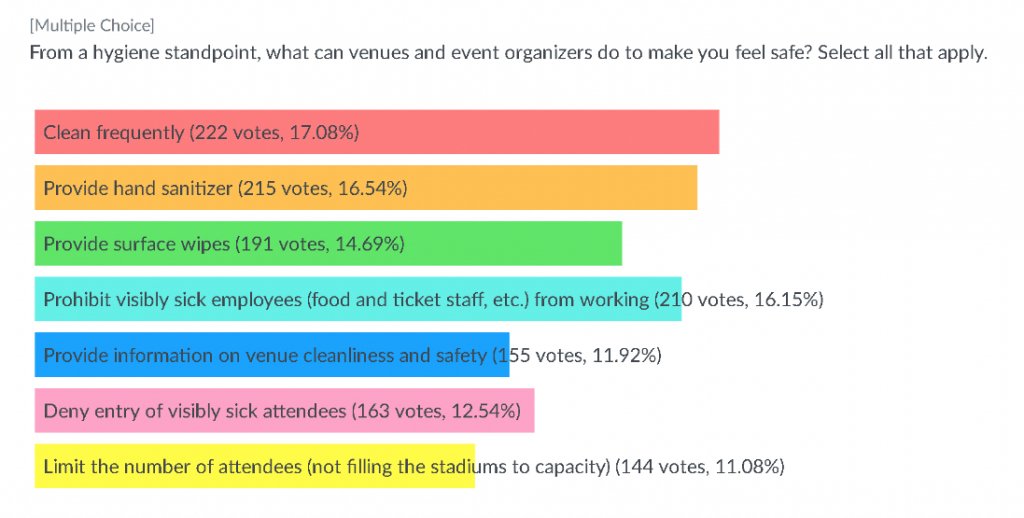

- The most popular response, selected by about 17% of respondents, is “Clean frequently.”

- The second-most-popular response, selected by over 16% of respondents, is “Provide hand sanitizer”

- Third place is “Provide surface wipes”

- Fourth place is “Prohibit visibly sick employees (food and ticket staff, etc.) from working

- Last place is “Limit the number of attendees (not filling the stadiums to capacity)”

- Considering the responses overall, respondents would feel most reassured by measures related to cleanliness.

○ One interviewee stated he’d also like to know the specifics about cleanliness. Many companies and venues say “we’re deep cleaning, cleaning more often,” but he wants to know exactly what that means. Is every inch disinfected? Is the cleaning only slightly more often?

○ One interviewee talked about stopping alcohol sales until COVID-19 is not a threat, because alcohol consumption makes people less cognizant of being sanitary and safe.

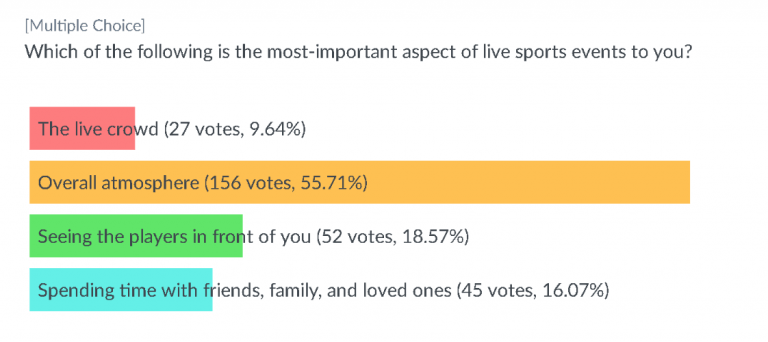

- A majority of respondents (55.7%) consider the overall atmosphere the most-important aspect of live sports.

○ This suggests that alternatives to live sports events should, to the extent possible, replicate this atmosphere.○ This was corroborated by 100% of interviewees.

The second-most-selected option was “Seeing the players in front of you”, suggesting attachment to/excitement in the presence of players.

Interviewees also talked about the social aspect of sporting events, supporting “Spending time with friends, family, and loved ones.”

"What I like the most about live sporting events is that in many ways, it’s just a day out. It turns into an event where we’ll have drinks before, go to the game, go have dinner later, so it’s a chance to spend time with friends and family and in many ways, the game is a background to essentially a social event. It’s a setting with which to hold a social event, but it’s also something obviously I’m interested in."

Summary of Sports Fan Attitudes towards Sports-Related Entertainment & Content

Recognizing the return to highly-attended sporting events won’t be immediate due to lack of COVID-19 testing, treatments and vaccines, what are the next opportunities in sports-related entertainment?

We polled and interviewed respondents about their favorite sports-related activities. Here’s a summary of the results and the insights.

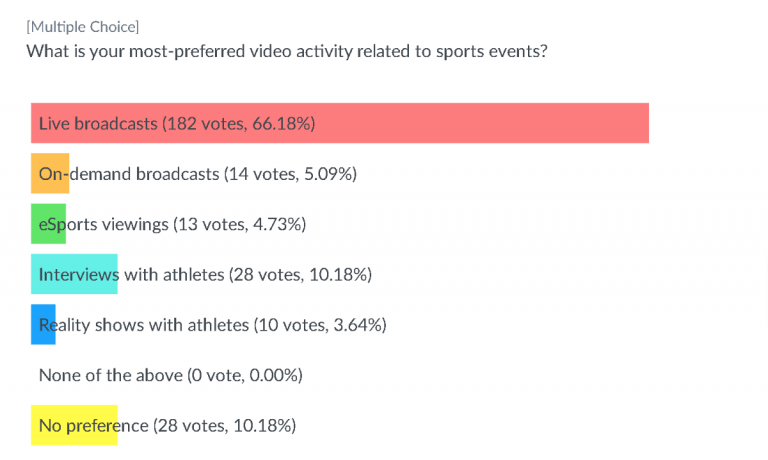

- A majority of respondents (+66%) consider live broadcasts their favorite video activity related to sports events. This suggests strongly that events without capacity attendance will enjoy strong viewership and the return of strong advertising and subscription revenues from OTT, cable and broadcast, as well as AVOD and SVOD streaming video.

- At 10%, and tied for second place were “Interviews with athletes” and “No preference”. This is a bit troubling, in that interview shows, talk shows, documentaries and other athlete-driven video productions are in short supply and difficult to scale in production and viewership, suggesting the audience will be small for this category of content, unless the focus of the video is the rare, transcendent superstar athlete.

○ The expressed sentiments corroborates the results of the previous question; participants want their video alternatives to closely replicate the atmosphere of live sports events (of the options presented, live broadcasts most replicate said atmosphere) and feel attachment to the athletes

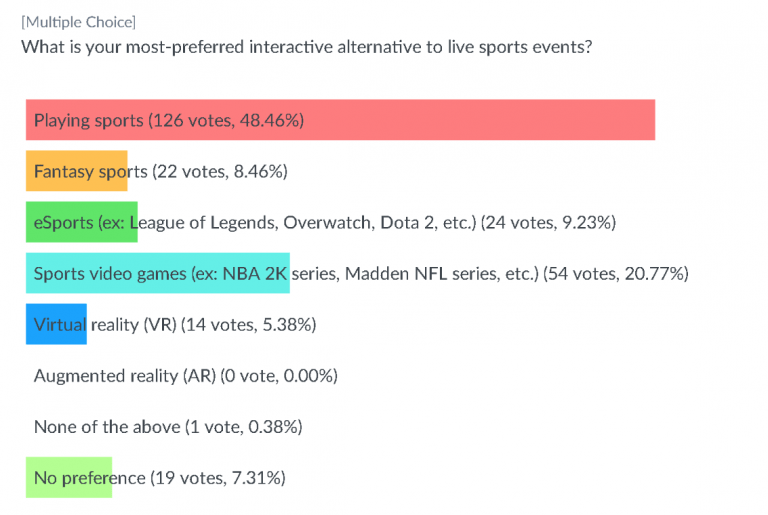

- Nearly 49% of respondents stated that playing sports is their favorite interactive (not video-based) alternative to live sports events.

- Nearly 21% of respondents chose sports video games, such as the NBA 2K and Madden NFL series, as their favorite interactive alternative activity.

- These results also corroborate the previous findings that suggest participants want to replicate the live sports atmosphere as closely as possible: actually playing sports, or playing sports video games, replicate the live sports atmosphere most. Virtual reality may possibly replicate live sports more than sports video games, but such technology is relatively new to the market and somewhat inaccessible to many populations.

○ Considering these factors, league-licensed VR sports games might’ve missed their best opportunity for adoption and growth.

It’s really no surprise that video games are popular alternatives to live sports attendance. What is surprising, the relatively small percentage of respondents preferring Fantasy Sports. And, I have to wonder if the high favorability of “Playing sports” isn’t inflated due to the desire to play sports during COVID-19 shelter-in-place. The timing of the survey would logically influence the stated preferences, but that’s hard to factor into responses or qualitative research without probing more deeply into the effect of shelter-in-place on respondents desire to be outside with increased activity levels.

Additional notes and anecdotes from methinks Research Operations during this Thinker:

- Interviewees talked about (a) apps, (b) sites and services, and (c) the “social aspect” of sports.

- Some things sports fans did during the pandemic or when they could not attend a live event:

○ Watch a broadcast with friends

○ Online sports trivia (Volo gaming)

○ Watch shows that fans upload

○ Watch shows that are being talked about

Click on the video below to watch the video interview highlights with our Thinkers about spectator life during and after COVID-19.